cimlainfo.ru

News

How Much Is A Vet Visit For A Cat Uti

How much do vet fees cost? ; Urinary Blockage, £1, ; Diabetes, £1, ; Tumour, £1, ; Kidney Disease, £ vet before considering them, as they may not be appropriate for your pet. Pet Insurance covers the cost of many common pet health conditions. Prepare. After googling I rushed him to an all night vet and was told treatment would be $ I could barely afford it but wasnt about to watch him die so I agreed. Contact your veterinarian for proper dosing. Powerful Tools to Help Your Cat's Urinary Tract & Bladder Challenges. There are many quick and easy changes you can. After googling I rushed him to an all night vet and was told treatment would be $ I could barely afford it but wasnt about to watch him die so I agreed. Of course, you can't completely prevent a urinary tract problem, but an ASPCA Pet Health Insurance plan can reimburse you for the cost of care. And they can get. However, these costs are assuming you'll only need to bring your pet in for regular visits and won't have any unexpected charges on your vet bill. If a regular. The best way to diagnose a UTI is to visit your vet for a cat check-up. Your Cat food that has too many minerals can cause the formation of crystals in your. After a vet visit and a course of antibiotics, the average cost of treatment for UTIs in dogs is about $ However, if the UTI develops into something more. How much do vet fees cost? ; Urinary Blockage, £1, ; Diabetes, £1, ; Tumour, £1, ; Kidney Disease, £ vet before considering them, as they may not be appropriate for your pet. Pet Insurance covers the cost of many common pet health conditions. Prepare. After googling I rushed him to an all night vet and was told treatment would be $ I could barely afford it but wasnt about to watch him die so I agreed. Contact your veterinarian for proper dosing. Powerful Tools to Help Your Cat's Urinary Tract & Bladder Challenges. There are many quick and easy changes you can. After googling I rushed him to an all night vet and was told treatment would be $ I could barely afford it but wasnt about to watch him die so I agreed. Of course, you can't completely prevent a urinary tract problem, but an ASPCA Pet Health Insurance plan can reimburse you for the cost of care. And they can get. However, these costs are assuming you'll only need to bring your pet in for regular visits and won't have any unexpected charges on your vet bill. If a regular. The best way to diagnose a UTI is to visit your vet for a cat check-up. Your Cat food that has too many minerals can cause the formation of crystals in your. After a vet visit and a course of antibiotics, the average cost of treatment for UTIs in dogs is about $ However, if the UTI develops into something more.

They visit the litter box more than usual because they cannot empty their bladder. They're straining to pee and unable to produce much urine. They cry, whine. Last year he was peeing blood and I rushed him to the vet. The cat had a slight urinary blockage that they were able to clear out without too much cost. However. Don't see a service you need? Just call for more information. Your veterinary team will provide the right services for your pet. Know more! In , cat UTI treatment costs range from roughly $ to $5, Urinary tract infections are often the result of bacterial growth in the urethra or bladder. About $50– That's cheap as far as vets go. DO NOT let the kitten suffer. If you can't take care of it-take it. Veterinary Tests and Diagnostic Costs ; Hypothyroidism, $ ; Sprains, $ ; Urinary Tract Condition (UTI), $ ; Kidney Failure, $ After the two weeks were up the vet wanted to recheck her urine sample again this cost roughly $. She was good to go. But after being off of the medication. FLUTD symptoms require an immediate vet visit. If you take nothing else away If you've ever had a urinary tract infection, you know just how much it hurts. If your cat has a UTI, not only is she in pain — pain which a visit to the vet will help with enormously — but if ignored, a UTI can easily lead to severe. The cost to treat a UTI can run anywhere from a few hundred dollars into the thousands, depending on the severity of the infection and what needs to be done. For example, if there are crystals in the urine, your veterinarian may recommend X-rays or an ultrasound of the abdomen to look for bladder stones. My. Surveys suggest that is the number one reason cats visit veterinary practices. Many pet food manufacturers market diets formulated for “urinary health. If your cat has a UTI, not only is she in pain — pain which a visit to the vet will help with enormously — but if ignored, a UTI can easily lead to severe. Typically, the attending vet team will treat your cat's blockage with the following protocols: Vet Visit Costs · New Puppy Checklist. Comparison Charts. ASPCA. More often than not, you should take your cat to the vet for her UTI. Many cats have recurring UTIs that can be difficult to get rid of. Your veterinarian can. Your vet will examine your cat and collect urine samples for testing and in some situations, a blood test will be required. Once a urinary tract infection has. A Urinary Tract Infection (UTI) is one of many urinary health related problems that can affect a cat. visit to the veterinarian is required to get a full. Going to see the vet? Be prepared to get the most out of your visit. Going to the veterinarian for a yearly wellness exam (or more often for older pets) is. To confirm if your cat has a urinary tract infection, a urinalysis will be ordered for the vet to determine the correct antibiotic that's sensitive to the. These described symptoms do not always mean that a UTI is present. All of these problems may occur because of diseases other than a UTI. For example, many cats.

Apps For Household Budgeting

We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Empower: Best for portfolio management. Empower, known prior as Personal Capital, is one of the best investment and budgeting tools available to deliver an. Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Share your budget and data across multiple phones. Home Budget is a solution for family finance management. The app enables families to create budgets, manage income amounts and categorise expenses. It also has. Editor's Pick: Best Budgeting Apps ; 2. Monarch Money. best budgeting app Monarch money. Monarch ; 3. Empower. best budgeting app Empower Personal. YNAB (You Need A Budget) specializes in helping people save money and get out of debt. It's accessible on iOS, Android, and desktop. The app focuses on building. Zeta offers several features that make it an ideal app for budgeting with others in your household. The app offers both personal and joint accounts that. A budgeting app is a mobile software application designed to accurately organize and track your weekly/monthly/yearly income, spending, and savings. As a result. YNAB is one of the best budget apps for iPhone and is also available for Android. Both iOS and Android users can try the app for a day free trial period;. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Empower: Best for portfolio management. Empower, known prior as Personal Capital, is one of the best investment and budgeting tools available to deliver an. Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Share your budget and data across multiple phones. Home Budget is a solution for family finance management. The app enables families to create budgets, manage income amounts and categorise expenses. It also has. Editor's Pick: Best Budgeting Apps ; 2. Monarch Money. best budgeting app Monarch money. Monarch ; 3. Empower. best budgeting app Empower Personal. YNAB (You Need A Budget) specializes in helping people save money and get out of debt. It's accessible on iOS, Android, and desktop. The app focuses on building. Zeta offers several features that make it an ideal app for budgeting with others in your household. The app offers both personal and joint accounts that. A budgeting app is a mobile software application designed to accurately organize and track your weekly/monthly/yearly income, spending, and savings. As a result. YNAB is one of the best budget apps for iPhone and is also available for Android. Both iOS and Android users can try the app for a day free trial period;.

Types of budgeting apps available. There are many well-reviewed budget and finance apps you can use to work toward your financial goals, such as: Goodbudget™. Goodbudget is a personal finance app perfect for budget planning, debt tracking, and money management. Share your budget and data across multiple phones (and. The app provides real-time updates on day-to-day spending (business and personal) and also the larger financial picture, so you know exactly how your startup is. Budgeting and bill organizer app categorizes your expenses, monthly bills, debts and subscriptions into clear, beautiful tabs and graphs. Personal and household budgeting system for the Web, Android and iPhone. Keep track of money to spend, save, and give toward what's important in life. Best Budgeting Apps for September · Best Overall: You Need a Budget (YNAB) · Best for Cash Flow: Simplifi by Quicken · Best for Overspenders: PocketGuard. Say hello to your new financial companion, Buddy. The joyful budgeting app The Family's Partner in Household Finance · Budget Bloopers and How to Avoid. Budget Planner on the go! Your Ultimate Monthly Budget Planner and Daily Expense Tracker! Are you tired of financial stress and complex money management. YNAB (You Need A Budget) specializes in helping people save money and get out of debt. It's accessible on iOS, Android, and desktop. The app focuses on building. General overview: PocketGuard is a standout among the best budgeting apps for its ease of use and practical features. This personal finance management app. Best app for planners: Simplifi by Quicken ; Best app for serious budgeters: You Need a Budget (YNAB) ; Best app for investors: Empower ; Best for being easy. My wife and I use Mint to track out joint accounts as well as personal accounts (from pre-marriage). We like Mint because it allows us to. Best for Beginners: Simplifi and Tiller If you're new to using a budgeting app, you can ease in with one of these choices. Quicken's Simplifi features easy-to. Mint: This basic budgeting app is an option for people who want to track their everyday spending and follow a simple budget. It's also an ideal free budgeting. A simple and easy-to-use Budget App. Budget App makes managing personal finances as easy as pie! Daily income and expense recorder, budget planner. Money Manager - the #1 financial planning, review, expense tracking, and personal asset management app for Android! Money Manager makes managing personal. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. Manage your personal finances and easily track your money, expenses and budget. Try the web app or download the app for your devices. Try the. WEB APP. Get it. Moneyhub is a comprehensive but simple to use budgeting app which provides one of the most accurate evaluations of your net worth. Unlike other apps, it factors. A list of personal finance apps to keep you on track while on-the-go · The ability to share your spending and budget with someone else · Goal tracking: YNAB wants.

Why You Should Get Solar Panels

As long as you buy, rather than lease, your solar panel system, you'll lock in electricity costs for the next 25+ years. Once you recover the initial cost of. In 10 years, you'll have gotten a complete return on your investment. While solar panels lose efficiency after their first decade, maintaining them should. Solar panels can save you money on your electricity bills, and they typically pay for themselves in 10 years or less. Solar panels can even increase home value. Seven reasons why you should use solar panels · What is a 'Solar Panel'? · Reduced Electricity Bills · Lower Carbon Footprint and Environmental. To make a final decision, you have to consider the costs. As with most products, cheaper options may seem tempting. Saving cash upfront is always inviting, but. Providing electricity – Solar panels can generate the electricity you need to light your home and power your appliances. If you make your home more energy. I think many of us on this board have found it to be 'worth it' both financially (multiple year payback) and in other ways. Save on your power bills You should see a saving on your electricity bill, because you will be using power from your solar panels during the day rather than. 1. Solar energy is a renewable energy source and reduces carbon emissions · 2. Solar energy can reduce your home's electricity bill · 3. Solar power can get you. As long as you buy, rather than lease, your solar panel system, you'll lock in electricity costs for the next 25+ years. Once you recover the initial cost of. In 10 years, you'll have gotten a complete return on your investment. While solar panels lose efficiency after their first decade, maintaining them should. Solar panels can save you money on your electricity bills, and they typically pay for themselves in 10 years or less. Solar panels can even increase home value. Seven reasons why you should use solar panels · What is a 'Solar Panel'? · Reduced Electricity Bills · Lower Carbon Footprint and Environmental. To make a final decision, you have to consider the costs. As with most products, cheaper options may seem tempting. Saving cash upfront is always inviting, but. Providing electricity – Solar panels can generate the electricity you need to light your home and power your appliances. If you make your home more energy. I think many of us on this board have found it to be 'worth it' both financially (multiple year payback) and in other ways. Save on your power bills You should see a saving on your electricity bill, because you will be using power from your solar panels during the day rather than. 1. Solar energy is a renewable energy source and reduces carbon emissions · 2. Solar energy can reduce your home's electricity bill · 3. Solar power can get you.

Installing solar panels lets you use free, renewable, low carbon electricity. You can sell surplus electricity to the grid or store it for later use. According. Solar is a renewable source of energy. You never have to worry about rising fossil fuel prices or the environmental impact of burning fossil fuels. Solar. Learn about the benefits of installing solar panel energy. Solar energy provides an alternative to the main grid power, helping create energy independence. Installing solar panels will increase the weight on the structure of your roof. If the weight of these solar panels is too much for your roof to handle, there. The reason to get solar isn't just to save money. It's to install the infrastructure on your house to self sufficient because utilities are. In addition, they are environmentally friendly. When calculating the cost and savings that solar panels offer, you should consider tax rebates and other. Reduce the cost of the electric bill: PV panels produce power through the sun, letting you buy less power from the grid. · It's a great source of renewable. Despite being a leading clean energy technology, there is still a lot of mystery surrounding installing home solar panels. There are several benefits to getting. Altogether, the use of solar panels let you save electricity and get rid of huge electricity bills just by utilizing the natural energy resource i.e. Sun. About. Solar panels are more efficient, affordable, and environmentally friendly than they've ever been, and the 30% federal tax credit makes solar an even more. Installing solar panels allows you to collect energy from the sun, which lowers your dependence on fossil fuels to generate electricity, thus helping the. With solar power, your costs will not go higher than the cost of the system. You might end up paying over k for 25 years of electricity bills, or more. Under “billing period” you should see a figure labeled kilowatt-hour (kWh) used. If your home's energy use is above kWh per month, you're likely a good. The only water needed is rainwater to naturally clean the panels when they get a bit grubby! Solar energy supplies are massive; if we could harness all of the. Solar panels do give a number of benefits – some are fairly obvious, but there are others you may not have thought of: Lower energy bills. Producing your own. Your home's overall value usually rises when you install solar panels. The Lawrence Berkeley National Laboratory of the US Department of Energy estimates that. Installing solar PV panels on your roof is one of the easiest and most practical ways of contributing to a sustainable future. Though most of us would love to. Homes with solar panels rely less on the grid by capturing energy directly from the sun. Homeowners can offset their energy usage with solar panels and reduce. No greenhouse gas emissions are released into the atmosphere when using solar panels to create electricity. And because the sun provides more energy than we'll. As a homeowner or business owner, installing solar PV panels can help you reduce your monthly electricity bill and benefit from significant savings long term.

Mortgage Lenders For Itin

We can walk you through the ITIN mortgage process step by step, making it fast and easy to apply. To get started, call us at () ITIN Mortgages and Loans · About ITIN Mortgages From Strata Credit Union. • Financing for residents who possess a valid Individual Tax ID Number (ITIN) required. ITIN Mortgage Requirements · At least one borrower must have a valid ITIN number, and must have had it for at least two years · Two forms of ID are required. Your ITIN allows you to take out a tax id loan- in which you do not need to show legal residency. Your credit history is evaluated based on your ITIN by making. The guide consolidates best practices, tools, and resources from credit unions and other stakeholders that have refined ITIN lending over many years. Our ITIN Loan Product is ideal for foreigners or aliens who do not have proper documentation or a Social Security Number. Offer home financing to a broader client base, including non-U.S. citizens, with A&D Mortgage's ITIN Mortgage Loan program. Research Blvd., Suite , Rockville, MD · () Not all loan programs are available in all areas. Program restrictions may apply. 20 DSCR lenders. We have 20 lenders with ITIN mortgage options ; Lenders offers. We get offers from lenders tailored to your particular situation ; Help from. We can walk you through the ITIN mortgage process step by step, making it fast and easy to apply. To get started, call us at () ITIN Mortgages and Loans · About ITIN Mortgages From Strata Credit Union. • Financing for residents who possess a valid Individual Tax ID Number (ITIN) required. ITIN Mortgage Requirements · At least one borrower must have a valid ITIN number, and must have had it for at least two years · Two forms of ID are required. Your ITIN allows you to take out a tax id loan- in which you do not need to show legal residency. Your credit history is evaluated based on your ITIN by making. The guide consolidates best practices, tools, and resources from credit unions and other stakeholders that have refined ITIN lending over many years. Our ITIN Loan Product is ideal for foreigners or aliens who do not have proper documentation or a Social Security Number. Offer home financing to a broader client base, including non-U.S. citizens, with A&D Mortgage's ITIN Mortgage Loan program. Research Blvd., Suite , Rockville, MD · () Not all loan programs are available in all areas. Program restrictions may apply. 20 DSCR lenders. We have 20 lenders with ITIN mortgage options ; Lenders offers. We get offers from lenders tailored to your particular situation ; Help from.

However, if you have an Individual Taxpayer Identification Number (ITIN), you may still be able to qualify for a loan. In order to do so, you'll need to have at. RGCU offers offer a home loan solution to our members who have Individual Taxpayer Identification Numbers (ITINs) instead of Social Security Numbers. Accessible Home Loans. By refinancing your existing loan, your total finance charges may be higher over the life of the loan. ITIN Mortgage Loans, No SOCIAL # REQUIRED! Home Loans, Warranted Condo Loans, CONVENTIONAL Loans. Make Us Your First Call ()-ATBLISS. Program Details · $, maximum loan amount* · Up to 95% financing** · No Private Mortgage Insurance (PMI) · Available for single-family residences that are. You'll hardly find any ITIN lenders who can do less than 10% down. Asertaloans is the best ITIN lender. cimlainfo.ru The ITIN Mortgage Program is designed to help non-U.S. citizens purchase homes in the United States. It is offered by certain lenders who are willing to work. ITIN Affordable Advantage Mortgage from Simmons Bank was designed for homebuyers who do not have a Social Security number. The ITIN Mortgage Program is designed to help non-U.S. citizens purchase homes in the United States. It is offered by certain lenders who are willing to work. ITIN loans are a type of alternative documentation lending program that is designed for owner-occupied borrowers with less-than-perfect credit. They are an. Borrowers with ITIN cards can qualify for a mortgage as long as they meet the eligibility requirements. This loan product is a full doc non-QM mortgage offering. Yes, you can purchase a house using an ITIN number in Illinois through a qualified ITIN loan lender. Using an ITIN loan allows you to qualify for financing. Our ITIN mortgage program can provide you with the resources you need to buy a home. At TwinStar, we're here to help you pursue your dream of home ownership. The Sauk Valley Bank ITIN Loan Program is designed to help eligible ITIN holders, apply for a home loan. Eligible borrowers are those who have not yet obtained. Our ITIN home loan program helps people living in the United States who have not yet received a social security number apply for a loan using their ITIN. No Social security number? Don´t worry! Our ITIN loan program is available in all 50 states and provides nontraditional credit options. Apply now! ITIN and DACA recipients are able to obtain a variety of nonqualified mortgages through private lenders that will either service the loans in their own. ITIN Home loans in texas. Find your perfect home loan to buy your new home or refinance your current property. Contact us Leader in Tax ID Loans & Mortgage Solutions. Prysma Lending Group has helped thousands of families since realize their dream of home ownership through ITIN. ITIN (Individual Taxpayer Identification Number) mortgage loan programs are designed to provide financing options to borrowers who do not have a Social.

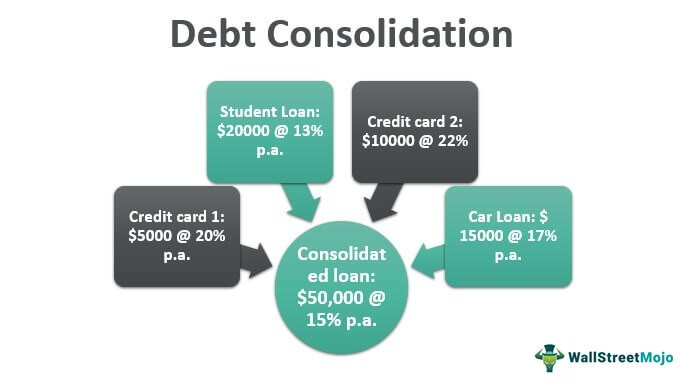

Debt Consolidation Rules

Rules for including debt consolidation loans in your debt management This is an interesting question and a situation that people often get into when they're. Debt consolidation is when you combine multiple debts into one personal loan. Here's an example: If you owe $6, in credit card debt and $4, in medical. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Am I eligible for an Achieve debt consolidation program? · Personal loan. Eligible debt: $5,$50, Credit score: minimum · Home equity loan. Eligible. A personal loan is among the best debt consolidation options when it comes with a low enough interest rate and affordable monthly payment. It should show. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated. Debt consolidation is when an individual takes out a loan to pay off several different existing debts, eg loans, overdrafts or credit card borrowing. Why Accounts Get Closed on a Debt Consolidation Program Consolidated Credit's Financial Education Director April Lewis-Parks explains why credit card accounts. Approach 3: Credit card consolidation In addition to the benefit of streamlining your high-interest-rate debt into a single monthly payment, this can often. Rules for including debt consolidation loans in your debt management This is an interesting question and a situation that people often get into when they're. Debt consolidation is when you combine multiple debts into one personal loan. Here's an example: If you owe $6, in credit card debt and $4, in medical. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Am I eligible for an Achieve debt consolidation program? · Personal loan. Eligible debt: $5,$50, Credit score: minimum · Home equity loan. Eligible. A personal loan is among the best debt consolidation options when it comes with a low enough interest rate and affordable monthly payment. It should show. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated. Debt consolidation is when an individual takes out a loan to pay off several different existing debts, eg loans, overdrafts or credit card borrowing. Why Accounts Get Closed on a Debt Consolidation Program Consolidated Credit's Financial Education Director April Lewis-Parks explains why credit card accounts. Approach 3: Credit card consolidation In addition to the benefit of streamlining your high-interest-rate debt into a single monthly payment, this can often.

Information for consumers on managing debt. Primary tabs. A loan consolidation combines a number of loans into a single new loan with a lower interest rate and a new payment plan. Loan consolidation has. Credit card debt consolidation is a good way to get a handle on monthly payments and decrease debt, but it must be done right if you want to do it without. 2. Consolidate debt with loans or lines of credit. · Apply for a debt consolidation loan, and then pay just the single monthly payment on your new loan · Open a. If you can't make the payments — or if your payments are late — you could lose your home. Most consolidation loans have costs. In addition to interest, you may. Borrower must be a U.S. citizen or permanent U.S. resident at least 18 years of age. All loan applications are subject to credit review and approval and offered. Personal Loans for Debt Consolidation A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired. Consolidating your debt can be done in various ways, and one option is to use your home's equity. This method is known as a home equity loan or a home equity. Therefore, the resulting payment could not be sufficiently low to affect your financial situation. Get in touch with our law firm in Oklahoma county to know. Before taking out a debt consolidation loan · Always pay your existing debts in full · Cut up your credit cards and cancel previous credit agreements in writing. Debt consolidation means combining all of your debts – such as medical bills or credit card balances – into a single monthly payment. Approach 3: Credit card consolidation In addition to the benefit of streamlining your high-interest-rate debt into a single monthly payment, this can often. Rolling all your bills into one can make debt easier to manage and may help save you money. Depending on details like the interest rate and repayment rules of. Rules for including debt consolidation loans in your debt management This is an interesting question and a situation that people often get into when they're. However, consolidation could also extend your repayment period (how long it takes you to pay off your loan). For example, consolidation could raise your. Here are several debt consolidation rules and regulations that you should know about in the event you receive correspondence from a company offering these. Why choose Upstart for a debt consolidation loan? We think you're more than your credit score. Our model looks at other factors, like education³ and. To qualify, a borrower must be a U.S. citizen or other eligible status, be residing in the U.S., and meet SoFi's underwriting requirements. Not all borrowers. Does a personal loan for debt consolidation hurt your credit? Example 4: Company D says it can consolidate custom- ers' multiple credit card payments into a lower single monthly payment. When a person signs up for the.

How To Start Investing In Individual Stocks

Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Beginners make money in the stock market by starting with the basics: invest in index funds. These funds mirror the performance of major market indexes like the. When buying individual stocks, you see reduced fees. You no longer have to pay the fund company an annual management fee for investing your assets. · You. Easy steps to start investing online · 1 · Open an account · 2 · Put money in · 3 · Pick an investment · 4 · Place your trade. Investors often think of selecting individual of stocks as the domain of sophisticated types. Meanwhile, mutual funds are often considered the province of. For example, Navy Federal Investment Services Digital Investor allows you to invest as little as $1 per individual stock or exchange traded fund (ETF). 2. Set. Depending on your goals, you have a number of investment choices. Stocks can play an important role in a portfolio because they are potentially an. How to Start Investing in Stocks: 5 Steps · Step 1: Determine Your Investing Approach · Step 2: Decide How Much You Will Invest in Stocks · Step 3: Open an. Buy individual stocks and bonds—This is the most complicated and labor-intensive way, but it's what many people think of when they hear "investing." If you want. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Beginners make money in the stock market by starting with the basics: invest in index funds. These funds mirror the performance of major market indexes like the. When buying individual stocks, you see reduced fees. You no longer have to pay the fund company an annual management fee for investing your assets. · You. Easy steps to start investing online · 1 · Open an account · 2 · Put money in · 3 · Pick an investment · 4 · Place your trade. Investors often think of selecting individual of stocks as the domain of sophisticated types. Meanwhile, mutual funds are often considered the province of. For example, Navy Federal Investment Services Digital Investor allows you to invest as little as $1 per individual stock or exchange traded fund (ETF). 2. Set. Depending on your goals, you have a number of investment choices. Stocks can play an important role in a portfolio because they are potentially an. How to Start Investing in Stocks: 5 Steps · Step 1: Determine Your Investing Approach · Step 2: Decide How Much You Will Invest in Stocks · Step 3: Open an. Buy individual stocks and bonds—This is the most complicated and labor-intensive way, but it's what many people think of when they hear "investing." If you want.

The first step of how to start investing in the stock market is easy enough. Before you buy your first stock, you have to have an account to hold it. Individual stocks offer the customization and transparency that mutual funds, index funds and ETFs generally do not. Your financial advisor can work with you to. How to Pick Stocks: 5 Things All Beginner Investors Should Know · Nothing in the Stock Market Is Guaranteed · Know You're Betting on Yourself · Know Your Goals. Where to begin · Figure out your goals – A clear understanding of why you want to invest in the first place will help you to set specific goals. · Identify your. Open an Account: Open a brokerage account to begin investing. Dollar-Cost Averaging: Invest regularly regardless of market conditions. Research. Investing in individual stocks is almost always a loser as compared to sticking with index funds. If you do choose to invest in individual stocks. Find investing ideas from top global minds and align your portfolio with a rapidly transforming cimlainfo.rute 3. Evaluate individual securities. Is the. Start by diversifying your portfolio with ETFs or mutual funds. If you want, you can also fill out your portfolio using individual securities. Individual stocks. Stocks are the first thing most people think about when they are considering investing, but they are not the only option. The prices of. Individual stocks are purchased in what is called shares. Buying one or more shares means you own a piece of that company. There are two ways to make money with. Diversify your portfolio without worrying about investing in and managing multiple individual stocks Check out key information you can use as you begin your. Why you should learn to invest in individual stocks · #1 You become a better thinker. When you analyze businesses, you learn how the world works. Before you can start purchasing stocks, you need to select a brokerage account to do it through. You can choose to go with a trading platform offered by a. Open a brokerage account or download an investing app (it's free); Transfer in some money (you could start with just a few dollars); Buy stock in quality. Stocks can generally be purchased both online through a discount brokerage or through a full-service brokerage firm. You can choose to invest in individual. Investing in stocks. Investing in individual stocks can be tempting. · Investing in mutual and index funds · Investing in a retirement account · Investing in a. You'll be exposed to significant investment risk if you invest heavily in shares of your employer's stock or any individual stock. If that stock does poorly or. Most people think of stocks & bonds when they think of investing. But investing's First things, first. Before your start investing in the stock market, it. Investors A and C invested their yearly $2, investments in T-bills while waiting to invest in stocks. Each individual investor should consider these. Steps to get started. Decide what you're investing for; Pick a timeline for your goal; Identify your risk tolerance; Choose a provider.

Do Private Loans Look At Your Credit Score

Credit plays a large role in getting approved for a private student loan. Most traditional undergraduate students will require a cosigner in order to. In addition, FICO Scores look on your credit report for mortgage, auto, and student loan inquiries older than 30 days. If your FICO Scores find some, your. Among our partner lenders, you'll need a credit score of at least to qualify for a private student loan, although some lenders don't disclose their minimum. Whether it's an auto loan or a student loan, credit scores are affected by inquiries. Fair Isaac, the company behind the FICO score, has a pretty good. a private loan company that doesnt make decisions based on credit scores. They generally look at your debt-to-income, credit history, and. Co-signer requirement: does the loan require you to have a co-signer? You might need one if you have limited or poor credit history, or if the loan amount. Student loans impact your debt to income and debt to credit ratios; Loans may appear on your credit reports even while deferred. If you've been to college. Student loans show up on your credit report in two ways. Firstly, when you apply for a student loan and the lender does a credit check, it will result in a. * Any person with a qualifying credit score and who meets the lender's cosigner requirements can cosign the loan, but it's usually a parent or guardian who will. Credit plays a large role in getting approved for a private student loan. Most traditional undergraduate students will require a cosigner in order to. In addition, FICO Scores look on your credit report for mortgage, auto, and student loan inquiries older than 30 days. If your FICO Scores find some, your. Among our partner lenders, you'll need a credit score of at least to qualify for a private student loan, although some lenders don't disclose their minimum. Whether it's an auto loan or a student loan, credit scores are affected by inquiries. Fair Isaac, the company behind the FICO score, has a pretty good. a private loan company that doesnt make decisions based on credit scores. They generally look at your debt-to-income, credit history, and. Co-signer requirement: does the loan require you to have a co-signer? You might need one if you have limited or poor credit history, or if the loan amount. Student loans impact your debt to income and debt to credit ratios; Loans may appear on your credit reports even while deferred. If you've been to college. Student loans show up on your credit report in two ways. Firstly, when you apply for a student loan and the lender does a credit check, it will result in a. * Any person with a qualifying credit score and who meets the lender's cosigner requirements can cosign the loan, but it's usually a parent or guardian who will.

Most private student loan companies require a credit score in the uppers or higher to get approved. You can check your credit for free with Experian to get. This means they can no longer sue for the debt and it's no longer report on your credit report. The same thing happened to me and I could barely. However, your private student loans may be listed on your credit reports. If you find out that you do have a private student loan, you can get more. The short answer is yes—lenders will check your credit score when you apply for a college loan. The Best Private College Loans for Parents With Bad Credit. To get a student loan with bad credit, choose federal student loans first. For private loans you'll need a niche lender that doesn't consider credit. It affects how likely you are to be approved for everything from applying for a credit card to financing a new car to getting a mortgage for your first home. College student loans represent more than a fleeting financial obligation; they wield a lasting influence on your future credit standing and loan. Borrowers don't need a credit check to be considered (except for the Federal PLUS Loans for parents and graduate students). Some federal student loans offer. For most private lenders, good credit history can go a long way toward approval. Unfortunately, college students may lack the required credit score simply. Take repayment seriously: Remember that student loan repayment can have a dramatic positive (or negative) impact on your credit score. Making on-time payments. First, lenders often perform what's known as a credit check or a hard inquiry to review your credit reports and determine if you're a suitable candidate for a. Student loans are a type of installment loan, similar to a car loan, personal loan, or mortgage. They are part of your credit report, and can impact your. In evaluating a loan application, lenders will look at your co-signer's credit history. So, if your co-signer has a better credit score than you do, it. The FICO Score is like your personal scoreboard that measures how well you've been doing financially. It is often used as the standard for private loans and can. Even a single missed payment can significantly decrease your score, and any negative payments could stay on your credit report for up to seven years. Failing to. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product. It summarizes information in your credit report into a single number that lenders can use to assess your credit risk quickly, consistently, objectively, and. Each time you apply, your credit is reviewed and your credit score is affected. If you do not have a credit history, you will need a co-signer with a good. While you do need more than a minimum credit score for private student loans, there is no credit check when you apply for federal student loans. Did you know that you have a day window to shop for private loans before your credit score is affected? Only one inquiry will appear on your credit score.

How To Deposit Money Into Webull Instantly

Tap the Webull logo to select your account. · Transfers ➝ Deposit ➝ Wire · Read the wire deposit guidelines. · Use the remittance details provided to initiate the. Investing in fractional shares is a good way to dollar-cost average your money into the market. When utilizing this strategy on a regular basis, you will be. 1. Tap the Webull logo at the bottom of the screen · 2. Tap "Transfers" at the top of the screen · 3. Tap "Deposit" · 4. Choose your Deposit Method, "eDDA", "FAST". Transfer from Robinhood, Webull or TD Ameritrade, etc. To transfer from Robinhood, Wellbull, TD Ameritrade, Fidelity, E Trade, Cash App, Charles Schwab. Investment or retirement accounts · Workplace account like a (k) or (b) · Cash from a checking or savings account. Move cash, transfer investments and roll over retirement assets into your JP Morgan investment account. Don't have an account yet? Get started. The specific steps for depositing funds are as follows: Step 1: Homepage>>> Transfers>>> Deposit, choose the currency. Before it fully settles, Webull grants you a partial amount as provisional credit of Buying Power to start trading. If you make a deposit before. Webull only accepts bank transfers (ACH) for deposits. This means you need to link a bank account to your Webull account and transfer funds directly from there. Tap the Webull logo to select your account. · Transfers ➝ Deposit ➝ Wire · Read the wire deposit guidelines. · Use the remittance details provided to initiate the. Investing in fractional shares is a good way to dollar-cost average your money into the market. When utilizing this strategy on a regular basis, you will be. 1. Tap the Webull logo at the bottom of the screen · 2. Tap "Transfers" at the top of the screen · 3. Tap "Deposit" · 4. Choose your Deposit Method, "eDDA", "FAST". Transfer from Robinhood, Webull or TD Ameritrade, etc. To transfer from Robinhood, Wellbull, TD Ameritrade, Fidelity, E Trade, Cash App, Charles Schwab. Investment or retirement accounts · Workplace account like a (k) or (b) · Cash from a checking or savings account. Move cash, transfer investments and roll over retirement assets into your JP Morgan investment account. Don't have an account yet? Get started. The specific steps for depositing funds are as follows: Step 1: Homepage>>> Transfers>>> Deposit, choose the currency. Before it fully settles, Webull grants you a partial amount as provisional credit of Buying Power to start trading. If you make a deposit before. Webull only accepts bank transfers (ACH) for deposits. This means you need to link a bank account to your Webull account and transfer funds directly from there.

Deposit: Your available balance increases when deposits settle. Some accounts instantly receive buying power to trade before ACH deposits settle. Withdrawal. Definitely! Webull supports instant deposits with stablecoins. You can deposit popular stablecoins like USDT, USDC, and BUSD directly into your Webull account. You can transfer stocks, cash, and other eligible assets from your outside brokerages into Robinhood through ACATS. You can transfer all or part of an outside. We can help you transfer from Robinhood, WeBull, Charles Schwab and most US into partner banks (“Partner Banks”), where that cash earns interest. Instant buying power is provided while your ACH deposit is in transit so you can trade before the deposit settles, which takes 4 business days. Before your. Micro-deposit Verification: With this method, you'll verify your bank account by confirming two small deposits made by Webull into your bank account. Both. A transfer is moving money from one account into another. At Vanguard, you After your transfer is complete, your assets may not immediately appear. Tap the Webull logo to select your account. · Transfers ➝ Recurring Deposit ➝ Initiate a Schedule · Ensure that the correct bank account is linked to the deposits. When you open an account with Schwab, select "investment account transfer" as your funding option. Your account will be approved and ready to fund within. To set up a manual connection between itself and your bank, Webull sends very small deposits to your account after you provide your banking information. When. Tap on the Webull logo (bottom center) · Select the receiving account you wish to transfer to. · Select Transfers ➝ Deposit ➝ Webull Account. · Enter the transfer. A wire transfer is an electronic transfer of money between accounts, including accounts at different financial institutions. How to deposit by wire. Tap the Webull logo to select your account. · Transfers ➝ Recurring Deposit ➝ Initiate a Schedule · Ensure that the correct bank account is linked to the deposits. Transfer money from another financial company to your Vanguard account, including in-kind transfers between brokerage accounts. While Webull does not charge deposit fees and will credit the full amount we receive, your bank or other intermediary banks may apply fees including currency. Yes, Webull does offer an instant deposit feature, but with certain limitations. Here's how it works: Instant Buying Power: When you initiate a. PUT YOUR IDLE MONEY TO WORK. Your uninvested cash will generate a % APY into an agreement with Webull Financial LLC to offer Webull Financial. Your capital is at risk. You may lose money on your investments. LOW COST FOR US SHARES TRADES - Trade US shares from just basis points or % of the. You can choose to deposit money into your account through wire transfer, microdeposits (takes one or two days) or ACH deposit (happens instantly). Webull. deposit, withdrawal or stock transfer into Webull. If you want to into your USD Wallet will occur instantly. Since your local.

Naov Stock News

View the latest NanoVibronix Inc. (NAOV) stock price, news, historical charts, analyst ratings and financial information from WSJ. Get Nanovibronix Inc (cimlainfo.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. NanoVibronix stock triples in very active trading after upbeat report on UTI treatment. Shares of NanoVibronix Inc. more than tripled in very volatile and. NanoVibronix, Inc. Common Stock. %. Delayed (15 Min) Trade Data: View NanoVibronix Inc (NAOV) stock price today, market news, streaming charts, forecasts and financial information from FX Empire. Get Nanovibronix Inc (NAOV.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. View NanoVibronix, Inc. NAOV stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. NAOV will report The current price of NAOV is USD — it has increased by % in the past 24 hours. Watch NanoVibronix, Inc. stock price performance more closely on the. View the latest NanoVibronix Inc. (NAOV) stock price, news, historical charts, analyst ratings and financial information from WSJ. Get Nanovibronix Inc (cimlainfo.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. NanoVibronix stock triples in very active trading after upbeat report on UTI treatment. Shares of NanoVibronix Inc. more than tripled in very volatile and. NanoVibronix, Inc. Common Stock. %. Delayed (15 Min) Trade Data: View NanoVibronix Inc (NAOV) stock price today, market news, streaming charts, forecasts and financial information from FX Empire. Get Nanovibronix Inc (NAOV.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. View NanoVibronix, Inc. NAOV stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. NAOV will report The current price of NAOV is USD — it has increased by % in the past 24 hours. Watch NanoVibronix, Inc. stock price performance more closely on the.

NanoVibronix Inc News & Analysis · NanoVibronix Highlights Second Quarter Revenue Growth and Narrowing of Loss from Operations in Letter to Stockholders. View NanoVibronix (NAOV) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Trade commission-free with the. Webull offers Nanovibronix Inc NAOV historical stock prices, in-depth market News. Press Releases. Financial Reports. Profile. 1D. 5D. Daily. Weekly. Monthly. See the latest NanoVibronix Inc stock price (NAOV:XNAS), related news, valuation, dividends and more to help you make your investing decisions. Get Nanovibronix Inc (NAOV:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Find the latest NanoVibronix, Inc. financial news and headlines to keep up with the events that impact NAOV performance Nasdaq Stock Market. NAOV. 21, (GLOBE NEWSWIRE) -- NanoVibronix, Inc. (the “Company”) (NASDAQ: NAOV) announced today that the Company's Special Meeting of Stockholders, scheduled for. NanoVibronix (NAOV) stock is falling on Tuesday following news of a direct offering from the therapeutic ultrasound technology company. Today's Biggest Pre-. NanoVibronix (NAOV) stock is climbing higher on Wednesday after releasing independent results from a study of its UroShield medical device. What Is Going on. NAOV ; Bid: $ X 8 ; Ask: $ X ; Volume: NAOV NanoVibronix Inc. 11, $ $ (%). Today. Watchers, 11, Wk Low, $ Wk High, $ Market Cap, $M. Volume, 4, News · NanoVibronix Second Quarter Earnings: US$ Loss per Share (Vs US$ Loss in 2Q ) · NanoVibronix | Q: Q2 Earnings Report · Express News. NAOV ; Bid: $ X 8 ; Ask: $ X ; Volume: Latest NAOV Press Releases · 05/22/ AM ET. NanoVibronix Announces Commencement of UroShield Clinical Study at the University of Michigan · 05/16/ See the latest NanoVibronix Inc stock price (NAOV:XNAS), related news, valuation, dividends and more to help you make your investing decisions. NanoVibronix Inc (NAOV) has a Smart Score of N/A based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. NanoVibronix Inc News & Analysis · NanoVibronix Highlights Second Quarter Revenue Growth and Narrowing of Loss from Operations in Letter to Stockholders. NanoVibronix (NASDAQ:NAOV) Stock Quotes, Forecast and News Summary ; Day Range, - - - ; 52 Wk Range, - ; Market Cap, $M ; P/E Ratio, - ; Dividend Yield. NanoVibronix (NAOV) stock is climbing higher on Wednesday after releasing independent results from a study of its UroShield medical device. What Is Going on. NanoVibronix Inc. · NanoVibronix Inc. News · Premarket Movers Monday: NanoVibronix, Alibaba, Lumen, Hasbro · NanoVibronix Jumps on Positive UTI Medical Device.

Safest Place To Keep Your Money

Among the safest places and most accessible products to stash your emergency fund include, high-yield savings accounts, money market account and no-penalty CD. Key Takeaways: · Savings accounts offer easy access to funds. · With FDIC insurance, savings accounts provide peace of mind, ensuring up to $,** of your. Where Is the Safest Place to Put Your Retirement Money? The safest place to put your retirement funds is in low-risk investments and savings options with. Be vigilant: Pickpockets target tourists. Keep your cash, credit cards, and passport secure in your money belt, and carry only a day's spending money in your. All are designed to contain and hide valuables under your clothing. These include money belts and various types of document pockets that dangle by thin straps. In this case, you should take your time and perhaps put the money aside until you feel ready to make decisions about it. Interest-bearing accounts, including. Bank or credit union account — If you have an account with a bank or credit union—generally considered one of the safest places to put your money—it might make. A savings account keeps your money in a safe place until you need to access those funds. When it comes to comparing a checking vs. savings account, the main. Among the safest places and most accessible products to stash your emergency fund include, high-yield savings accounts, money market account and no-penalty CD. Among the safest places and most accessible products to stash your emergency fund include, high-yield savings accounts, money market account and no-penalty CD. Key Takeaways: · Savings accounts offer easy access to funds. · With FDIC insurance, savings accounts provide peace of mind, ensuring up to $,** of your. Where Is the Safest Place to Put Your Retirement Money? The safest place to put your retirement funds is in low-risk investments and savings options with. Be vigilant: Pickpockets target tourists. Keep your cash, credit cards, and passport secure in your money belt, and carry only a day's spending money in your. All are designed to contain and hide valuables under your clothing. These include money belts and various types of document pockets that dangle by thin straps. In this case, you should take your time and perhaps put the money aside until you feel ready to make decisions about it. Interest-bearing accounts, including. Bank or credit union account — If you have an account with a bank or credit union—generally considered one of the safest places to put your money—it might make. A savings account keeps your money in a safe place until you need to access those funds. When it comes to comparing a checking vs. savings account, the main. Among the safest places and most accessible products to stash your emergency fund include, high-yield savings accounts, money market account and no-penalty CD.

At Vanguard, we offer several cash investments where you can keep your emergency fund. If you're living without a safety net, you're living on the. So your money is as safe as it would be in a traditional savings account. Should I put all my money in a high-yield savings account? Most HYSAs limit. All money in the state-owned bank NS&I is fully backed by the Government, meaning money put in there is as near to % safe as you can get. It'd take the UK. However, cybercriminals are capitalising on opportunities to steal consumers' passwords, identities and money. Internet security tips — to help you protect your. One option is to open a checking account at a bank or credit union where your money will be protected and insured. An FDIC-insured savings account is a great place to keep emergency funds but be sure to do your research and pick an account that suits your needs. When should. We work hard to make Schwab a secure and safe place for your money. Whether you hold securities like stocks, bonds, mutual funds, exchange traded funds, or. Plus, your money is insured up to $, per depositor, per institution as long as your bank is backed by the FDIC or the National Credit Union Administration. A basic savings account provides a safe place to keep your cash (and earn some interest, too) Safety and security: Money kept in a traditional savings. Protecting Your ATM Card. Always protect your ATM card and keep it in a safe place, just like you would cash, credit cards or checks. Do not leave your ATM. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. Savvy travelers avoid keeping all of their cash, credit cards and checks in one place, like a wallet or purse. If that one item somehow goes missing, you're. We're licensed to hold your money and, as part of keeping it safe, we follow strict rules set out by the regulators in the countries where we operate. They are FDIC insured up to $,, providing security and easy access to funds. Certificates of Deposit (CDs). CDs provide fixed interest rates and are also. Which bank is safe to keep money? Make sure any bank you are considering is insured by the FDIC. Look for the Member FDIC logo in the footer of their website. Money market funds. · Dividend stocks. · Ultra-short fixed-income ETFs. · Certificates of deposit. · Annuities. · High-yield savings accounts. · Treasury bonds. If you are looking to earn interest on your money in the safest possible manner, the best option is to keep your money in a savings bank account. Where should you put the money? Emergency savings are best placed in an interest-bearing bank account, such as a money market or interest-bearing savings. These are solid options, but money market accounts may be worth considering. They can provide a mix of safety, growth and liquidity for your savings as you plan. Almost all banks offer automated transfers between your checking and savings accounts. You can choose when, how much and where to transfer money or even split.